And in the end with everything said and done...Wall Street is back doing what Wall Street does. It will soon be breaking the regulations and laws they always have. The regulators will go back to not seeing. By Friday there won't be a story on it again, they are doing the wrap ups today.

Hope you came out ok.

Blown, it is like lift, only bigger, better, longer, stronger, harder... and that’s just the car. The first Rotrex supercharged 2zz Spyder.

WTF! am I right that this revelation should include Jail time?

Should include? Yeah, but it won't.I have looked at and understood what is "legal" in shorting the market for over 30 years. It is mandatory for you to actually borrow real shares to short. Whether you get them or get your broker to. It has never been legal for more shares to be borrowed than have been issued...It has been done for decades that I know of, and I am sure decades before I looked at it. I don't know of it ever being charged let alone been prosecuted for doing so.Multi-billon dollar hedge funds with billionaires and multi-millionaires aren't even looked at by SEC. You don't get jailed when the SEC ignores/condons it.

Last time I actually shorted was Trump when he was losing money hand over fist in Atlantic City casino. It is hard to lose money when the odds favor the house. Particularly when his name alone was supposed to be a draw. I don't think he meant for it to be the tax write-off that it became for hm. He probably came out ahead, unlike his investors. He made me money from shorting him.

Blown, it is like lift, only bigger, better, longer, stronger, harder... and that’s just the car. The first Rotrex supercharged 2zz Spyder.

As more comes out the less and less it seems the little guy made out well, or that the Hedge Funds were damaged. Like I said in my first post. The Hedge Funds have people read and analyze what was happening and the Hedge Funds figured out how to win...most of them anyway. The small timers discussed it on the internet. Did they think the hedge funds didn't read and plan anything?

Blown, it is like lift, only bigger, better, longer, stronger, harder... and that’s just the car. The first Rotrex supercharged 2zz Spyder.

Friday of the following week it is trading at $61, down from the flat top of ~330, ignoring the spikes.

That's how squeezes end, when the target was a frickin' dog to begin with. There was a very good reason the short interest was so high initially. Think of all the bag-holders who got in at $250+.

They will be howling about how things are rigged, but in reality, they actually just don't know shit about how the market works. Whining about their free-commission Tier 3 broker is killing them. Like I said, whether intentional or not, restricting new longs at the height of that gore-fest was doing the dumb money a favor.

There is plenty of Screw The Little Guy to legitimately bitch about, like the restrictions on pattern day trading and margin requirements and the 25K minimum account balance. Thats the SEC regs screwing us over. Then therevare lots of market-maker shenanigans. But being left with the bag and the consequences of "irrational exuberance" in the midst of a squeeze, meh, that's a simple dumb money problem, LOL.

Hope you got out without getting hurt, fellas. Maybe pulled some sushi off the table, even.

🐸, 2003, Electric Green Mica

The funny thing, the whole silver thing was a narrative co-oped by other forces, it wasn't us. In fact, the theory was that paid shills were using reddit to drive attention away from GameStop. Once the media started pointing the finger at WallStreeBets - people starting using the name for their own cause. None of us ever gave a damn about NOK, or AMC. None of us discuss crypto or commodities. GME was the only one that had short float above 100% and so few shares issued.

Glad you made out good. I had a few thousand tied up in DOGE coin and I just cashed out yesterday after Musk ran his mouth. Again, wsb never pumped crypto either... it's banned in discussion as is OTC stocks and small caps.

I closed out my GME positions. I didn't sell it at the top for 3000%, but made about half that.

The funny thing about this whole story is that the snowball was mostly media driven. 7 million people didn't know about wallstreetbets until a few weeks ago. We weren't the ones running ads on CNBC with logos of the subreddit. People don't get that it was never an investment subreddit. Mostly people making risky options bets with some DD here and there. We just happened to be right on this one.

I'm sure a lot of people bought at the top with money that shouldn't have been played, but a person should have the right to spend/lose money how they like. It's Wall Street. Nobody cares if you lose $5000 on lotto tickets - why should they care about your bad investment? The whole "protect people from themselves" argument is silly when it comes to money.

The squeeze didn't reach critical mass but it succeeded in adding more market participant and giving people some of the "voting" power back.

scottsmods.com

The whole "protect people from themselves" argument is silly when it comes to money.

I agree. I would go further that to "protect people from themselves" is not a good thing in general. I know that I certainly do not want others protecting me from my own good or bad decisions.

2007 S2000 (New Formula Red)

2005 Spyders (Two in Paradise Blue Metallic, One Super White)

2004 Tundra SR5 Double Cab (White with 2UZ-FE Engine)

2003 Tundra SR5 Access Cab (Silver Stepside with 2UZ-FE Engine)

2003 Sequoia SR5 (Black with 2UZ-FE Engine)

1970 Olds 442 W30 (Nugget Gold )

Robin Hood was not protecting anyone but themselves. That was not what I meant. I simply meant that they were doing them a favor anyway. If you were itching to buy at 330, no matter WHAT reason someone gave for denying you, they still did you a favor.

I know there was no shortage of chicanery going on, but the whining about a 3rd tier broker not being as "big boy" as people wanted them to be is like having your cake and eating it too. That's what people get for free. Wanna trade like big boys, get a big boy account. This is not directed at you, Scotched. Just generally.

Glad you made a 15-bagger. That's pretty sweet.

🐸, 2003, Electric Green Mica

Been off for a bit.... But did watch the GME story unfold along the way. Being primarily a crypto trader.... I knew exactly how this would end. Kudos to WSB for initiating the squeeze.... well played. The media made it way more of a mess than it had to be in my opinion, as they do, then the dumb money piled in. I think the story that gave me the best laugh was about the 20somethings family man that makes 35k a year who suddenly was a millionaire on paper... But refused to cash out. "I'm sticking it to the man" "I want to see how high it goes." Lol. That is life changing money.... Why would you continue to risk it all? I can't think of a better way to stick it to the man (with no real capital) than playing a game and walking away with 7 figures of the man's money. I sure hope that guy changed his mind and got out with something worthwhile.

I'll stick to what I know... Keep playing with nothing more than a small piece of the previous cycles profit margin, and continue to put the rest into real assets for my family.

Been off for a bit.... But did watch the GME story unfold along the way. Being primarily a crypto trader.... I knew exactly how this would end. Kudos to WSB for initiating the squeeze.... well played. The media made it way more of a mess than it had to be in my opinion, as they do, then the dumb money piled in. I think the story that gave me the best laugh was about the 20somethings family man that makes 35k a year who suddenly was a millionaire on paper... But refused to cash out. "I'm sticking it to the man" "I want to see how high it goes." Lol. That is life changing money.... Why would you continue to risk it all? I can't think of a better way to stick it to the man (with no real capital) than playing a game and walking away with 7 figures of the man's money. I sure hope that guy changed his mind and got out with something worthwhile.

I'll stick to what I know... Keep playing with nothing more than a small piece of the previous cycles profit margin, and continue to put the rest into real assets for my family.

From what I was told some of it was a younger generation seeing their families hurt during the financial crisis of 2008 where some of them lost their homes. They have all grown up now and in a position to expose the system.

The plan was sound.

We predicted shenanigans, but we didn't realize how far the powers that be would take it. Bot army infecting the subreddit, the discord takedown, brokers shutting down buy orders, and a coup/installed moderators at WSB. A lot of vitriol and emotional trading for sure. Some of the people thought, might as well let 1k ride ... you'll lose thousands, the HF's lost billions.

Most of us took profits, we just didn't advertise it. Then there were some wealthy dudes with 1M play money who were just there to have fun - posting their loss porn of 300K. But there were also whales in on it (we suspected other hedge funds) who kept pushing it above $300 with order blocks of like 10,000 shares at a time - who has that kind of money? So this little conflict ended up a proxy war.

scottsmods.com

Gotta love the whale orders that make the momentum bots and hair-trigger bid/ask quant bots lose their ****. Gets really fun when there are bots on both sides that keep upping the trade size.

🐸, 2003, Electric Green Mica

I think that paper millionaire is full of it. He would have needed to buy 1250 shares at $5, then flipped for $405. Best timing ever.

But that 1250 shares would have cost 6,250. At 35K a year, he is plunking down 6K on a trade. I doubt it... smells funny. Better than bragging about losing 300 BIG, tho. Lol, people

🐸, 2003, Electric Green Mica

Saw it on mainstream news.... I do think he mentioned he dropped 5k on it in the beginning.... I'll see if I can find it.

https://www.cnn.com/videos/business/2021/01/29/trader-millionaire-gamestop-stock-orig.cnn

Ok, now I am dying to know if or when he cashed out.

🐸, 2003, Electric Green Mica

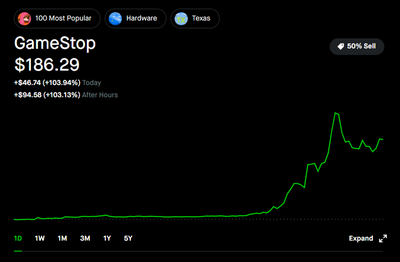

Welp, looks like the boys are back at it again.

It was slowly bottoming to $40 last few weeks. Doubled market hours today to $90ish, double that AH to $180.

I'm off this roller coaster already but damn what a ride! Lot of folks bought some sweet calls for a couple of bucks, printing thousands now.

scottsmods.com